The 2023 Game Plan*

- Claudia S

- Apr 2, 2023

- 4 min read

Updated: Jan 6

January 3, 2023

Happy New Year everyone! Wishing you health, love and a better stock market for 2023!

2022 was a rough year for all sorts of investments, not only stocks but also bonds, real estate, crypto, NFT, you name it. And even though we all knew the prior rally was too good to be true, it was still painful to watch our investments lose value throughout the year. Worth to pause for a second to let it sink in: “When something is too good to be true, it simply is not true”.

Looking forward to 2023, I also remind myself “The stock market has a mind of its own, and nobody can predict what is going to happen”. So, let’s just keep moving forward with caution and the knowledge that we are in it for the long run 🙂

As an aside but related to “the market has a mind of its own”, over the past 12 months, I read a couple of Michael Lewis’ books: “The Big Short”, “Liar’s Poker”, and I’m currently reading “The Flash Boys”. The books let us in behind the scenes to show how greed and big egos run Wall Street. I swear if it wasn’t for being in the stock market for the last 15 years, I might be too afraid to get in after reading the books. At the same time, perhaps it is the same people that will make sure it keeps growing over time.

Alright, getting back on topic, here is my 2023 Game Plan. It follows a similar outline as the one I shared for 2022.

1. Trading Range: Based on my GDP to DJI/S&P growth analysis, I plan using the following trading range:

Dow: 24,000 - 29,000

S&P 2,900 - 3,500

This means, I’ll buy a portion of the stocks I would like to own when the indices trade within that range.

This range assumes a GDP growth of 1.9% and 0.5% in 2022 and 2023 respectively (as per OECD), and it translates to about a 10-25% drop for both the Dow Jones and S&P500 indices. For the sake of our investments, I hope this doesn’t materialize, and if it doesn’t, that means I won’t be trading much in 2023. My alternative trigger point to buy stocks will be when/if the Fed and BoC take their rates back to ~2%; which might only happen in 2024.

2. Cash/GIC/Equity split: I’m starting the year with a 25/25/50 split. In the long run, I’d like to have more equity, less cash and about the same in GIC’s. This past year, I shopped around and was able to secure the below GIC ladder:

Something that might be helpful to know is that in Canada, the government (through the CDIC) secures investments of up to $100,000 in GICs by institution and by type of account (here is a link to a list of the institutions that are covered by the CDIC). This means that you can have a $100k GIC in your RRSP, and $100k GIC in your TFSA with the same bank, and the government protects your $200k investment in the unlikely event that the bank goes under.

3. Portfolio Review: In addition to rebalancing my portfolio at the end of each year, I also do a deeper dive on the stocks I own and on others that I might be interested in buying. Overall, I’m happy with the portfolio I had chosen with two small changes, I’m replacing Bell Canada with Telus, and Square with Paypal.

Although Bell Canada is a solid Canadian company, Telus has a better P/E ratio (18.1 vs. 19.5) and has also delivered a positive EPS growth in the P5Y. Analysts are expecting a 24% appreciation over the next 12 months compared to 9% for Bell. To note, analysts tend to be overtly optimistic so I wouldn’t take their numbers at face value; it just shows there is a stronger belief in Telus.

FinTech had a rough year in 2022; however, I believe that the biggest players will get back to fast growth once interest rates settle back down to an average level of 1-2%. As for Square, I’m a big fan of Jack Dorsey and I do like Square; however, I wonder if they will be able to bounce back as fast given their investments in crypto, the Tidal streaming service, plus their acquisition of AfterPay at the peak of the market. On the other hand, Paypal is trading at its cheapest levels since being spun out from eBay, it has positive earnings and has spent a significant amount on repurchasing shares. They have already declared it will focus on their core strengths after trying to diversify to other technologies.

So, here is what my StockTalk 2023 portfolio looks like:

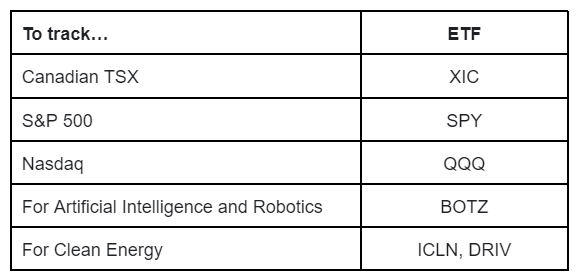

4. ETF’s: In addition, I will continue to invest in ETF’s, both on those that track the main indexes: TSX, S&P and Nasdaq, as well as on those that allow me to learn more about new industries. The only change I have made vs. last year is selling BLOK. Although I think that block chain technology is here to stay and that cryptocurrency will eventually find its place, I anticipate next year to be rough for any companies betting on blockchain or crypto.

And that sums up the plan. Hoping for a better year in the stock market in 2023.

Claudia Soler

* Disclaimer: The information contained within this blog is for informational purposes only and it is not intended as a recommendation of the securities highlighted or any particular investment strategy; nor should it be considered a solicitation to buy or sell any security. In addition, this information is not represented or warranted to be accurate, correct, complete or timely. the securities mentioned in this blog may not be suitable for all types of investors and the information contained in this blog does not constitute advice. Before acting on any information in this blog, readers should consider whether such an investment is suitable for their particular circumstances, perform their own due diligence, and if necessary, seek professional advice.